Financial Coaching

Master your money with the Dave Ramsey 7 Baby Steps. We provide the strategy and accountability you need to reach Financial Peace.

See Coaching PlansYour Path to Financial Freedom

Income is your greatest wealth-building tool. We help you bridge the gap between where you are and where you want to be. Eliminate debt, build wealth, and leave a legacy.

The 7 Baby Steps

Starter Emergency Fund

Save $1,000 for unexpected life events to keep you from going back into debt.

The Debt Snowball

Pay off all debt (except the house) smallest to largest balance to build momentum.

Full Emergency Fund

Save 3–6 months of expenses in a liquid account to protect your family's future.

Invest 15% for Retirement

Allocate 15% of your household income into tax-advantaged retirement accounts.

College Funding

Save for your children’s future education using 529 plans or ESAs.

Pay Off the Home

Direct any extra funds toward your mortgage to reach total debt freedom sooner.

Build Wealth and Give

Live and give like no one else. Continue building wealth and being incredibly generous.

Pricing & Packages

Quick Start

- Initial Consultation Only

- Best to Learn about Service

- A 30-minute “power session”

- Access Extended Trial of Monarch Money

6 Coaching Sessions

- 60-minute “power sessions”

- Dave Ramsey 7 Baby Steps

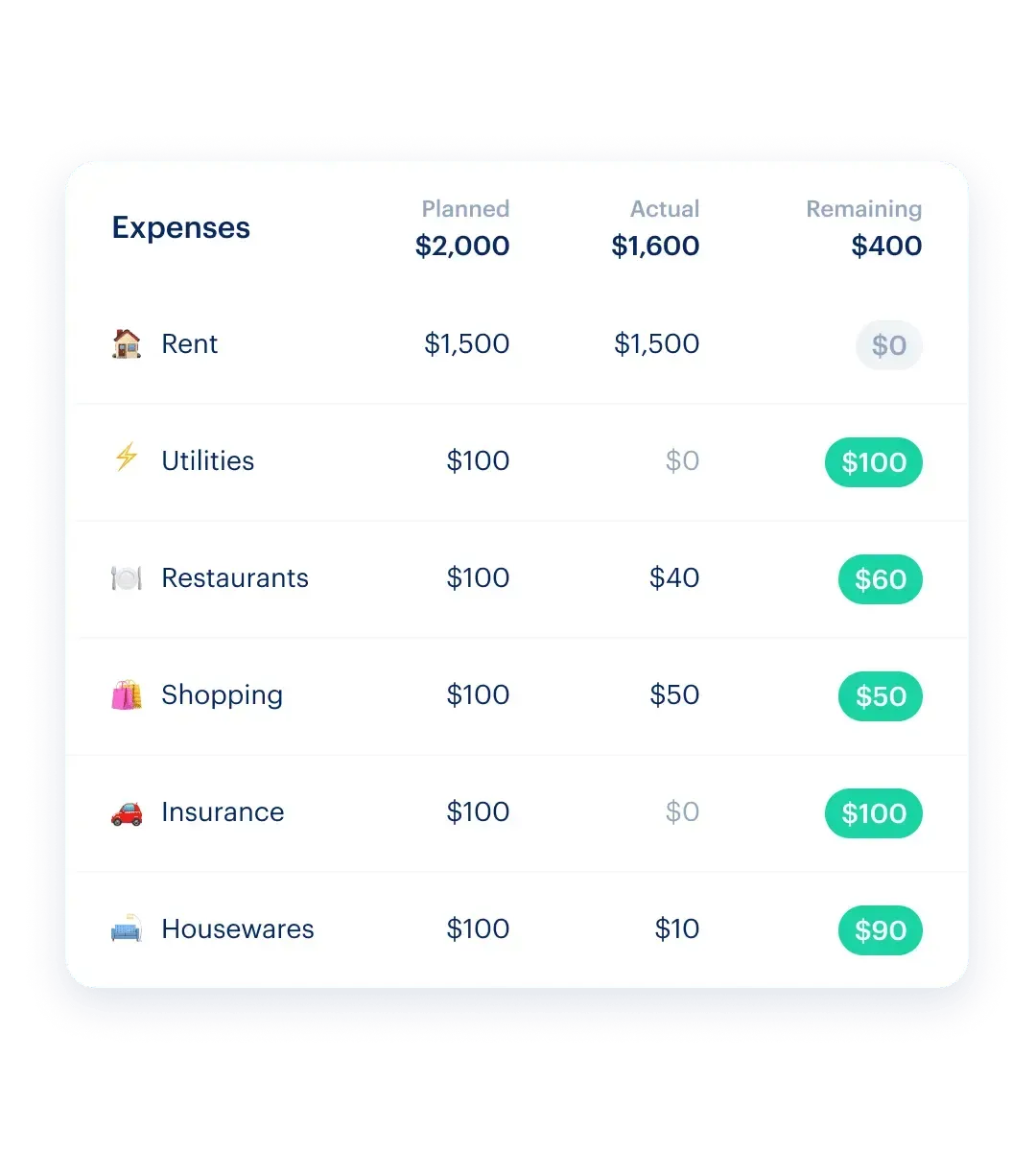

- Personalized Budget Planning

- Learn how to “Snowball” debt

- Using an Emergency Fund

- Monarch Money Tool Included

Single Hourly

- Single Coaching Session

- Best for Specific Module

- A 60-minute “power session”

- Monarch Money NOT Included

- Access Extended Trial of Monarch Money

Budgeting Simplified

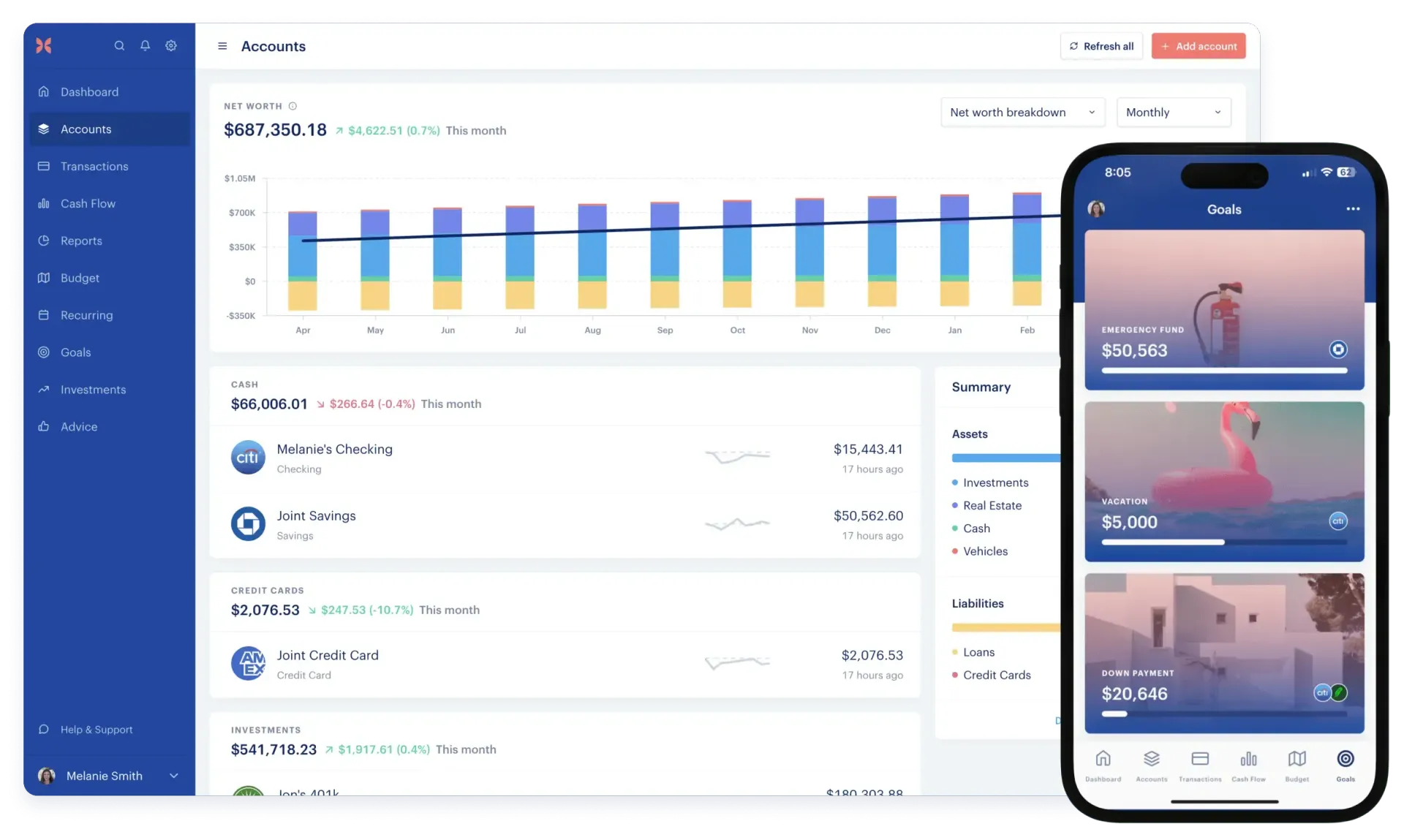

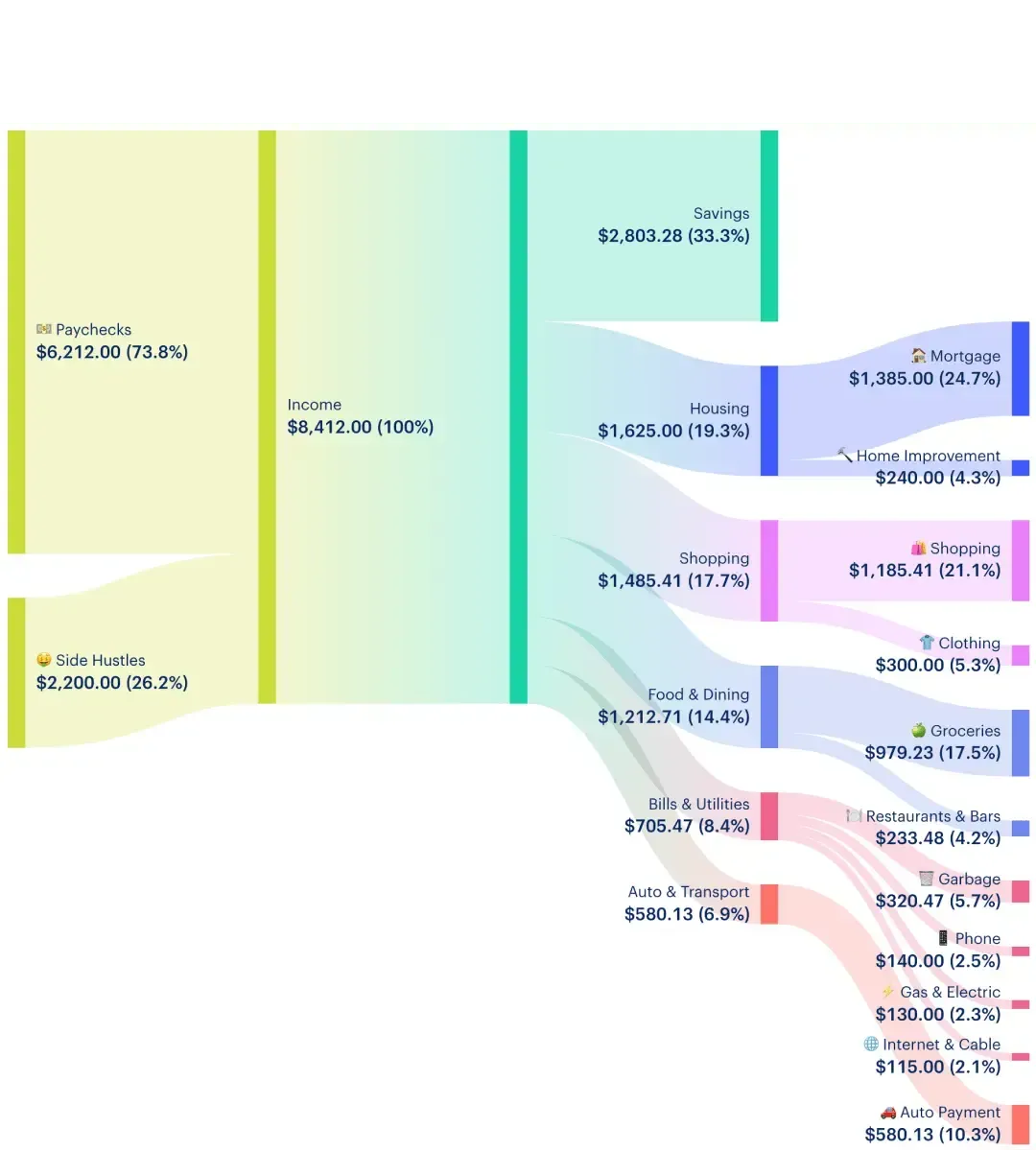

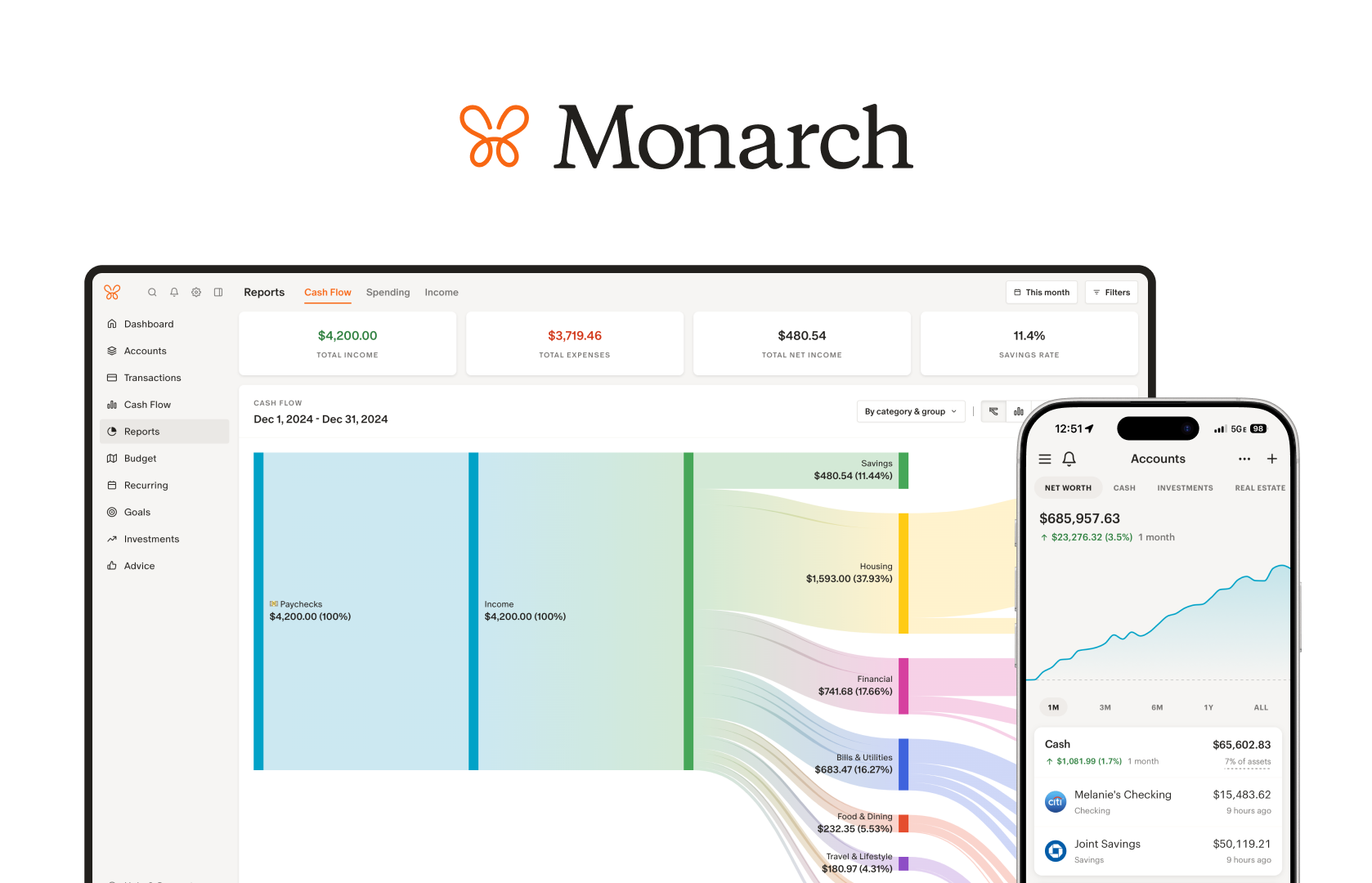

Track your Baby Steps progress with the #1 platform for personal finance.

Get 50% Off Monarch Money for 1 YearLimited time offer through University Financial Strategies

Win With Money

- ACCOUNTABILITY: Stay on track when life gets busy.

- CUSTOM STRATEGY: Tailored plans for your family.

- EXPERT GUIDANCE: Professional support on every step.

- REDUCED STRESS: Shift from worry to a winning plan.

Empower Yourself Using Monarch Money

Smart Decisions With Great Tools

Take Control of Your Financial Future with Expert Coaching

Schedule a personalized consultation to start applying the Dave Ramsey Baby Step process using Monarch’s budgeting tools. Gain clarity, reduce financial stress, and build lasting stability with guidance tailored to your goals.

Common Questions About Financial Coaching

Find clear answers to frequently asked questions about our financial coaching services, the Dave Ramsey Baby Step process, and how to begin your journey toward financial confidence with University Financial Strategies.

What is financial coaching and how does it work?

Financial coaching provides personalized guidance to help you manage your money, reduce debt, and build wealth. Our approach focuses on your unique goals, using the Dave Ramsey Baby Step process combined with the Monarch budgeting tool to create actionable plans and ongoing support.How do the Dave Ramsey Baby Steps improve financial stability?

The Baby Steps break down financial goals into manageable stages, starting with saving an emergency fund and ending with building wealth and giving generously. This structured path helps reduce overwhelm and keeps you focused on measurable progress.What is the Monarch budgeting tool and why is it used?

Monarch is a comprehensive budgeting platform that tracks your income, expenses, and investments in one place. It integrates seamlessly with our coaching to provide real-time insights, helping you stay on track with your Baby Step goals.How do I get started with University Financial Strategies?

Begin by scheduling a consultation via Zoom. We’ll review your current financial situation, introduce the Baby Step process, and set up Monarch budgeting tailored to your needs. Our coaching sessions are designed to fit your schedule and provide ongoing accountability.Can financial coaching help with emotional challenges around money?

Yes. Our coaching addresses the emotional aspects of money management, helping you overcome stress, fear, and confusion. By following a clear plan and receiving consistent support, you gain confidence to make decisions that align with your values and goals.

Ready to Take Control?

Connect with University Financial Strategies to begin your personalized financial coaching journey. Use the Baby Step process and Monarch budgeting to build a secure financial future with expert guidance every step of the way.