Kickstart 2026: New Year's Resolutions to Boost Your Financial Health

Kickstart 2026: New Year's Resolutions to Boost Your Financial Health

Most people start the year with New Year's resolutions that lose steam by February. If your financial goals feel out of reach, you're not alone. This year, focus on simple personal finance strategies that make a real difference. Keep reading for 2026 finance tips that help you improve finances, save money, and build lasting financial wellness. Learn more about making financial resolutions that actually work.

Setting Financial Goals

Your money deserves a clear direction. Financial goals work like a GPS for your money, showing exactly where you want to go and the best route to get there.

Prioritize Financial Wellness

Financial wellness starts with honest self-assessment. What keeps you up at night about money? This question helps pinpoint your true financial priorities.

Many people jump into complex money plans without fixing basics first. Before chasing investment returns, make sure you have an emergency fund. A recent study found that 56% of Americans couldn't cover a $1,000 emergency without borrowing.

Your financial health connects directly to your physical and mental wellbeing. When you reduce money stress, you sleep better and think clearer. Try this simple exercise: write down your top three money worries, then create one small action step for each.

Financial wellness resolutions work best when tied to your personal values. Ask yourself what matters most - security, freedom, family support? Your answer shapes better financial choices.

Budgeting for the New Year

Budgets fail when they feel like punishment. The secret? Build a spending plan that includes fun money alongside savings goals.

Start with the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt payments. This simple framework helps you balance today's happiness with tomorrow's security.

Digital tools make budgeting much easier in 2026. Apps can automatically track spending, categorize purchases, and alert you when you're going over budget. Check out this deal with Monarch Money and get 50% off using this link.

Want a budget that actually works? Try the "pay yourself first" method. Set up automatic transfers to savings on payday before spending on anything else. This one habit builds wealth faster than almost any other financial strategy.

Saving Money Effectively

Saving feels impossible when you focus on big numbers. Break your goals into weekly targets instead. Saving $25 per week feels doable, and adds up to $1,300 per year.

The most powerful savings hack? Make it automatic. When money moves to savings before you see it, you adapt your spending to what's left. Studies show automatic savers build 3x more wealth than those who save manually.

Look for "painless" saving opportunities in your daily life. Cancel one subscription service you barely use. Bring lunch twice weekly instead of buying it. Shop insurance rates once yearly. These small changes create big results without feeling like sacrifice.

Challenge yourself with a 30-day spending freeze on non-essentials. Many people discover they don't miss most impulse purchases after the initial withdrawal period passes. Put the saved money toward your most important financial goal.

Investing in 2026

The best time to start investing was 20 years ago. The second best time is today. Even small amounts grow meaningfully over time.

Exploring Personal Finance Strategies

Personal finance isn't one-size-fits-all. Your strategy should match your life stage, goals, and risk comfort level.

Start by mapping your money flow - track where cash comes from and where it goes for two weeks. This simple exercise reveals spending leaks and saving opportunities you might miss otherwise.

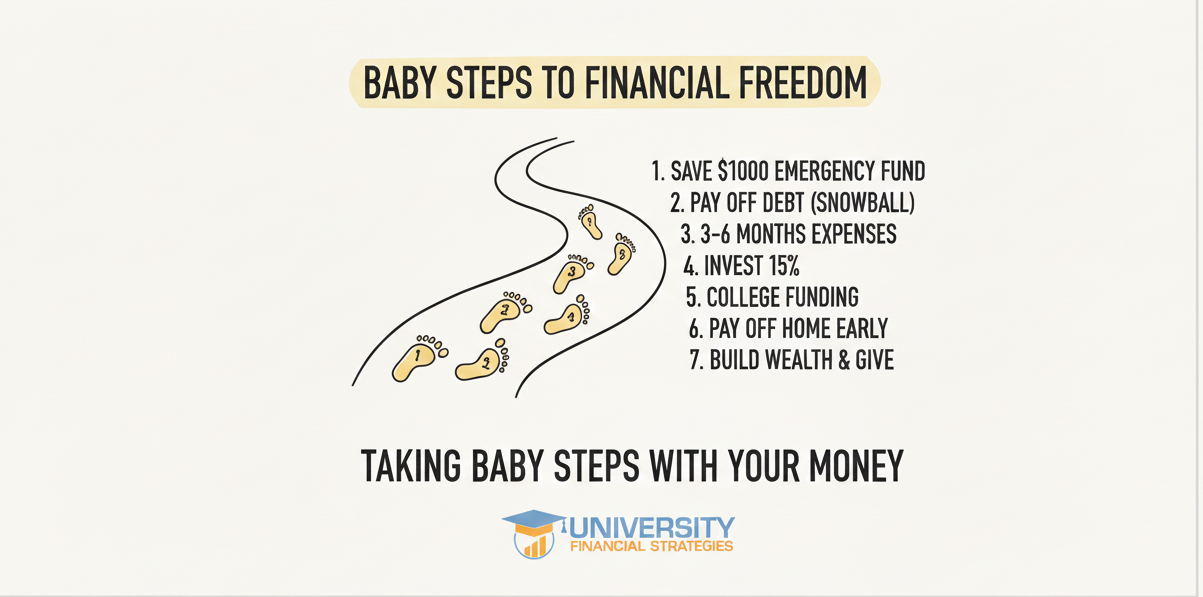

For young professionals, the "wealth ladder" approach works well: first build emergency savings, then eliminate high-interest debt, then max out retirement matches, then tackle other investments. This step-by-step method prevents spreading resources too thin.

Mid-career professionals should focus on "gap analysis" - calculating the difference between current savings and future needs. This number helps prioritize between competing goals like college funds, retirement accounts, and lifestyle upgrades.

Money experts recommend creating a "money date" with yourself monthly. Block 30 minutes to review progress, adjust plans, and celebrate wins. This simple habit keeps your financial plan alive and growing.

Smart Investment Choices

Investing feels scary when you don't understand it. The truth? You don't need complex strategies to build wealth.

Low-cost index funds remain one of the smartest choices for most people. These funds buy tiny pieces of hundreds of companies, spreading risk while capturing market growth. A simple S&P 500 index fund has outperformed 80% of professional investors over 15-year periods.

Dollar-cost averaging takes the guesswork out of market timing. By investing a fixed amount regularly, you naturally buy more shares when prices drop and fewer when prices rise. This strategy works in both up and down markets.

Watch out for fees - they silently eat away at returns. A 1% difference in annual fees can reduce your retirement savings by nearly $100,000 over 30 years. Always check the expense ratio before choosing investments.

Tax-smart investing boosts returns without extra risk. Maximize tax-advantaged accounts like 401(k)s, IRAs, and HSAs before using taxable accounts. The tax savings alone can add thousands to your long-term results.

Long-term Retirement Planning

Retirement planning works best when you visualize your future life. What will your days look like? Where will you live? These questions help determine how much money you'll actually need.

The "4% rule" provides a simple starting point: multiply your desired annual retirement income by 25. This rough calculation estimates how much you need to save. For example, $40,000 yearly income requires approximately $1 million in savings.

Social Security plays a crucial role in most retirement plans. Each year you delay claiming benefits (up to age 70) increases your monthly payment by about 8%. This guaranteed return beats most investment options for near-retirees.

Consider the "three bucket" approach to retirement savings: cash for short-term needs, moderate-risk investments for mid-term expenses, and growth investments for long-term spending. This strategy balances safety and growth throughout retirement.

Staying on Track

Financial plans only work when you stick with them. Let's explore how to maintain momentum all year.

Overcoming Financial Challenges

Financial setbacks happen to everyone. The difference between success and failure is how you respond.

When facing money troubles, avoid the ostrich approach - hiding from problems makes them worse. Instead, take quick action: contact creditors, revise your budget, and seek help if needed.

Build financial resilience through proper protection. Insurance isn't exciting, but it prevents catastrophic losses. Review your coverage for gaps in health, property, liability, disability, and life insurance.

High inflation presents unique challenges. Combat rising prices by focusing on "big wins" - renegotiating major expenses like housing, vehicles, and insurance rather than penny-pinching on small purchases.

If debt feels overwhelming, try the "debt snowball" method. List all debts from smallest to largest balance. Pay minimums on everything except the smallest debt, which gets extra payments. When it's gone, roll that payment into the next debt. This creates psychological wins that fuel motivation.

Monitoring Your Progress

Tracking your progress makes financial goals stick. People who regularly monitor their money are twice as likely to reach their targets.

Create a simple "financial dashboard" with 3-5 key numbers you check monthly. Good metrics include net worth, debt-to-income ratio, savings rate, and investment returns. Watching these numbers improves over time creates powerful motivation.

Beware of comparison traps. Social media shows highlight reels, not financial reality. Your only meaningful comparison is to your past self. Are you making progress toward your goals? That's what matters.

Set milestone celebrations when you reach financial targets. When you pay off a debt or hit a savings goal, reward yourself with something meaningful but affordable. This positive reinforcement strengthens good money habits.

Consider using a "money journal" to track your emotional relationship with finances. Note how different spending and saving decisions make you feel. Over time, patterns emerge that help you align money choices with true happiness.

Seeking Professional Guidance

Financial advice comes in many forms. Finding the right help at the right time can transform your money situation.

Start by understanding different types of financial professionals. Financial coaches help with budgeting and behavior. Financial planners create comprehensive strategies. Investment advisors focus on growing assets. Choose based on your specific needs.

When selecting an advisor, ask about their payment structure. Fee-only advisors charge directly for services without product commissions, reducing potential conflicts of interest. This transparency helps build trust.

Don't overlook free resources. Many libraries, community colleges, and nonprofits offer quality financial education. Online calculators and budget tools provide valuable guidance without cost.

The best financial guidance aligns with your values and goals. A good advisor listens more than they talk, especially during your first meeting. They should ask thoughtful questions about what matters to you before making any recommendations.

Financial success in 2026 comes from small, consistent actions rather than dramatic changes. By setting clear goals, creating simple systems, and staying flexible when challenges arise, you can make this the year your money works better for you. Remember that progress beats perfection - each positive step builds toward greater financial wellness.